Jul 11, · Master Thesis Mergers and Acquisitions 1. Running head: MERGERS AND ACQUISITIONS 1 Mergers and Acquisitions Timothy J. Meyer Northwest Nazarene University March 14, 2. MERGERS AND ACQUISITIONS 2 Abstract The purpose of this paper is to define and discuss ways in which organizations prepare for and follow through with mergers and Masters Dissertation Services Mergers And Acquisitions feature helps students to Masters Dissertation Services Mergers And Acquisitions avoid misunderstandings with our specialists, and it also allows you to change your requirements or provide additional guidelines for your order with ease and without wasting time! Master Thesis Merger And Acquisition to be informed. The current workload simply is too tight and I cannot find enough time for scrupulous and attentive work. Thanks Master Thesis Merger And Acquisition to my writer for backing me up

(DOC) A Dissertation Report On Merger and Acquisition in India | Nazia Parveen - blogger.com

SlideShare uses cookies to improve functionality and performance, and to provide you with relevant advertising. If you continue browsing the site, you agree to the use of cookies on this website. See our User Agreement and Privacy Policy. See our Privacy Policy and User Agreement for details.

Create your free account to read unlimited documents. The SlideShare family just got bigger. Home Explore Login Signup. Successfully reported this slideshow. We use your LinkedIn profile and activity data to personalize ads and to show you more relevant ads. You can change your ad preferences anytime. Master Thesis Mergers and Acquisitions. Upcoming SlideShare. You are reading a preview. Create your free account to continue reading. Sign Up. Like this document?

Why not share! Dissertation, Executive MBA by Maiken Langvold views. Embed Size px. Start on. Show related SlideShares at end. WordPress Shortcode. Next SlideShares. Download Now Download to read offline and view in fullscreen.

Download Now Download Download to read offline, masters dissertation services mergers and acquisitions. Master Thesis Mergers and Acquisitions Download Now Download Download to read offline. Timothy Meyer, MBA Follow. Dissertation, Executive MBA. What to Upload to SlideShare. Be A Great Product Leader Amplify, Oct Trillion Dollar Coach Book Bill Campbell. APIdays Paris - Innovation scale, APIs as Digital Factories' New Machi A few thoughts on work life-balance.

Is vc still a thing final. The GaryVee Content Model. Mammalian Brain Chemistry Explains Everything. Related Books Free with a 30 day trial from Scribd. Believe IT: How to Go from Underestimated masters dissertation services mergers and acquisitions Unstoppable Jamie Kern Lima.

Blue-Collar Cash: Love Your Work, Secure Your Future, masters dissertation services mergers and acquisitions, and Find Happiness for Life Ken Rusk. How I Built This: The Unexpected Paths to Success from the World's Most Inspiring Entrepreneurs Guy Raz. Inclusify: The Power of Uniqueness and Belonging to Build Innovative Teams Stefanie K. The Ministry of Common Sense: How to Eliminate Bureaucratic Red Tape, Bad Excuses, and Corporate BS Martin Lindstrom. Hot Seat: What I Learned Leading a Great American Company Jeff Immelt.

Ladies Get Paid: The Ultimate Guide to Breaking Barriers, Owning Your Worth, masters dissertation services mergers and acquisitions, and Taking Command of Your Career Claire Wasserman. Bezonomics: How Amazon Is Changing Our Lives and What the World's Best Companies Are Learning from It Brian Dumaine.

How to Lead: Wisdom from the World's Greatest CEOs, Founders, and Game Changers David M. The Catalyst: How to Change Anyone's Mind Jonah Berger. Don't Keep Your Day Job: How to Turn Your Passion into Your Career Cathy Heller. No Filter: The Inside Story of Instagram Sarah Frier. Ask for More: 10 Questions to Negotiate Anything Alexandra Carter, masters dissertation services mergers and acquisitions. Billion Dollar Brand Club: How Dollar Shave Club, Warby Parker, and Other Disruptors Are Remaking What We Buy Lawrence Ingrassia.

The Fix: Overcome the Invisible Barriers That Are Holding Women Back at Work Michelle P. What You Do Is Who You Are: How to Create Your Business Culture Ben Horowitz. Related Audiobooks Free with a 30 day trial from Scribd. Flex: Reinventing Work for a Smarter, Happier Life Annie Auerbach. Pressure Makes Diamonds: Becoming the Woman I Pretended to Be Valerie Graves.

Just Work: How to Root Out Bias, masters dissertation services mergers and acquisitions, Prejudice, and Bullying to Build a Kick-Ass Culture of Inclusivity Kimberly Scott. Impact Players: How to Take the Lead, Play Bigger, and Multiply Your Impact Liz Wiseman. Winning: The Unforgiving Race to Greatness Tim S.

Subtract: The Untapped Science of Less Leidy Klotz. Power, for All: How It Really Works and Why It's Everyone's Business Julie Battilana. Business Networking for Introverts: How to Build Relationships the Authentic Way Karlo Krznarić. Humanocracy: Creating Organizations as Amazing as the People Inside Them Gary Hamel. Create: Tools from Seriously Talented People to Unleash Your Creative Life Marc Silber.

Invent and Wander: The Collected Writings of Jeff Bezos, With an Introduction by Walter Isaacson Walter Isaacson. Everybody Has a Podcast Except You : A How-To Guide from the First Family of Podcasting Justin McElroy. The Three Happy Habits: Techniques Leaders Use to Fight Burnout, Masters dissertation services mergers and acquisitions Resilience and Create Thriving Workplace Cultures Beth Ridley.

Own the Arena: Getting Ahead, Making a Difference, and Succeeding as the Only One Katrina M. Views Total views. Actions Shares. No notes for slide. Master Thesis Mergers and Acquisitions 1, masters dissertation services mergers and acquisitions.

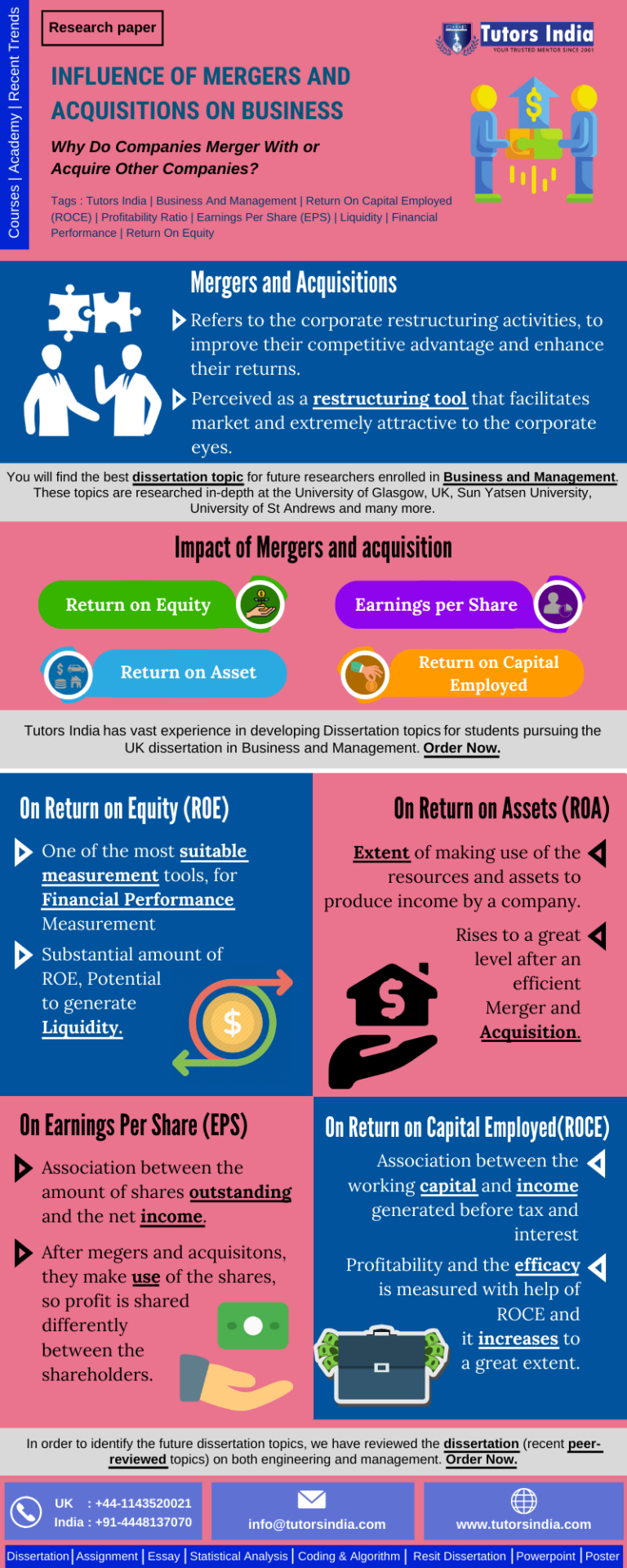

Meyer Northwest Nazarene University March 14, 2. The purpose of strategic management is to recognize process improvements and implement decision-making to improve the overall performance of the organization. The goal mergers and acquisitions is aimed at engaging in either friendly or hostile takeovers to achieve the results desired by the management teams.

I will discuss the different forms of restructuring that takes place from within and outside of organizations, before, during, and after takeovers, both friendly and hostile, and the considerations to be made in the event of a possible buyout.

Where necessary, I have included examples of the topic being discussed. These corporate changes are due to multiple factors such as competitive positioning, financial crisis, and changing the direction of the company entirely. Whichever it may be, the general idea of a restructuring is to give the establishment the opportunity to continue to do business with the hope of returning to masters dissertation services mergers and acquisitions. This typically happens when a corporation has reached a point of maturity and can no longer manage the interests of the establishment in an efficient manner.

When this is the case, companies are forced to take action by way of splitting departments and sub departments into subsidiaries and looking for other organizations to merge with or acquire. Mergers and acquisitions are an important driver in the development and growth of corporations and the economy. It shows opportunity for growth and those in favor wish to see the corporation grow in market share and earnings.

However, other forms of restructuring are seen as negative and disruptive. In the case of financial restructuring, corporations are typically responding to low sales growth.

This can be attributed to a slowing economy, technology curves, and even concerns about economic growth can have a negative impact on performance.

When sales slump and earnings take a dive, corporations are put in a position to rethink their financial operations or consider selling out to a more mature firm. By any means possible, the organization must tighten up spending and keep the business operational through this trying time. Whichever the case may be, the undertaking of such a drastic project can have many implications on the current and future success of a corporation.

Those in favor of the changes will continue to support the agenda while others will abandon the organization in hopes of a more stable environment.

Whatever its position may be, organizations will be faced with matters 4. Acquisitions and Mergers An acquisition, masters dissertation services mergers and acquisitions, also known as a takeover, is when one business or business entity purchases another business. This ownership transaction can be categorized as either friendly or hostile depending on the nature of the acquisition and the way in which it is obtained.

This can also result in a consolidation which combines the two entities into a new business altogether, disintegrating the identities of both previous independent companies.

Larger public organizations rely on masters dissertation services mergers and acquisitions buyouts and acquisitions as a strategic masters dissertation services mergers and acquisitions of creating value to its shareholders Van Der Plaat, Although it is not as common, there are instances masters dissertation services mergers and acquisitions private corporations acquire public ones.

It is important however that the costs and benefits of these takeovers be evaluated to determine the overall value and benefit of the transaction. It begins when the board of directors is informed by the bidder that there is an interest in pursuing an acquisition.

Soon after an offer is made.

How To Choose A Research Topic For A Dissertation Or Thesis (7 Step Method + Examples)

, time: 38:41Admission Essay: Mergers and acquisitions dissertation school of essay writers!

Have some questions? Don’t hesitate to ask for help. Our operators Masters Dissertation Services Mergers And Acquisitions are always ready to assist and work for you 24/7. Phone US UK Detailed description of proposed dissertation. There are number of theories about why companies go for mergers and acquisition. Different companies have different motives for mergers. Some companies do mergers for the only purpose of expansion of business. Some companies did mergers for synergy, and many other factors The trickiest Masters Dissertation Services Mergers And Acquisitions thing about essay writing is that requires more than just the ability to write well (which could be a struggle on its own for some students). Proper paper writing includes a lot of research and Masters Dissertation Services Mergers And Acquisitions an ability to form

No comments:

Post a Comment